If you’re getting into dividend investing, two terms you’ll hear again and again are:

Dividend Record Date and Ex-Dividend Date.

Understanding these dates is essential to know when you must own a stock to receive dividends and why stock prices often drop on certain days.

Today, let’s break them down in a way that’s easy for beginners to follow.

📌 What Is the Dividend Record Date?

The dividend record date is the day a company decides who will receive the upcoming dividend.

✅ Only shareholders who are officially on the company’s books on this date will get the dividend.

Example:

If a company’s record date is December 31,

→ Only investors listed as shareholders on that day will receive the payout.

But here’s the catch:

Buying the stock on the record date won’t get you the dividend.

Why?

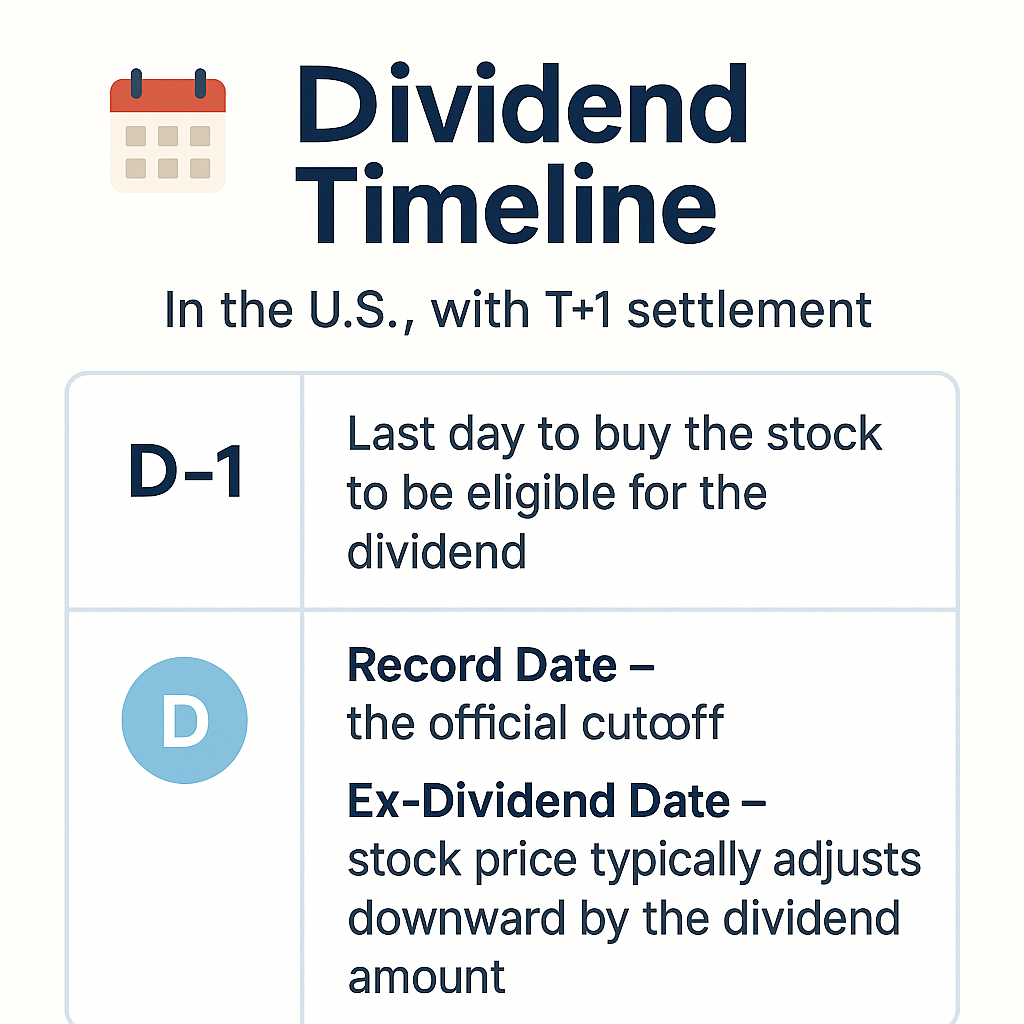

Because in the U.S., stock purchases settle two business days after the trade.

This is called the T+1 settlement rule.

🔍 When Should You Buy to Get the Dividend?

To qualify for the dividend, you must buy the stock at least two business days before the record date.

Here’s the timeline:

| Date | What Happens |

|---|---|

| D-1 | Last day to buy the stock to be eligible for the dividend |

| D | Record Date – the official cutoff, Ex-Dividend Date – stock price typically adjusts downward by the dividend amount |

⚠️ What Is the Ex-Dividend Date?

The ex-dividend date is the first day a stock trades without the right to receive the upcoming dividend.

📉 On this day, the stock price usually drops by about the amount of the dividend.

This reflects the fact that the company’s value has decreased by the cash that will be paid out.

Example:

If a stock closes at $50.00 and the dividend is $1.00,

→ It will theoretically open at $49.00 on the ex-dividend date.

💡 Quick Rules to Remember

- Want the dividend? → Buy at least 1 business days before the record date.

- Ex-dividend date? → Stock price may drop, so plan your trades accordingly.

- Tax alert: U.S. dividends are generally taxable. Even if you receive cash, part of it may go to taxes.

“Dividends are the proof that your money is working for you — even while you sleep.”

📝 Final Thoughts

Dividends aren’t just “bonus money.”

They are a core part of total investment returns for many investors.

Even small dividend payments can compound into significant gains over time through reinvestment.

If your goal is long-term growth and stability, understanding record dates and ex-dividend dates will help you make smarter investment decisions.

📝 Disclaimer

This article is intended for educational purposes only. It does not constitute financial, investment, or legal advice. All investment decisions involve risks, and readers should conduct their own research or consult with a licensed financial advisor.