🌐 What The Company Does

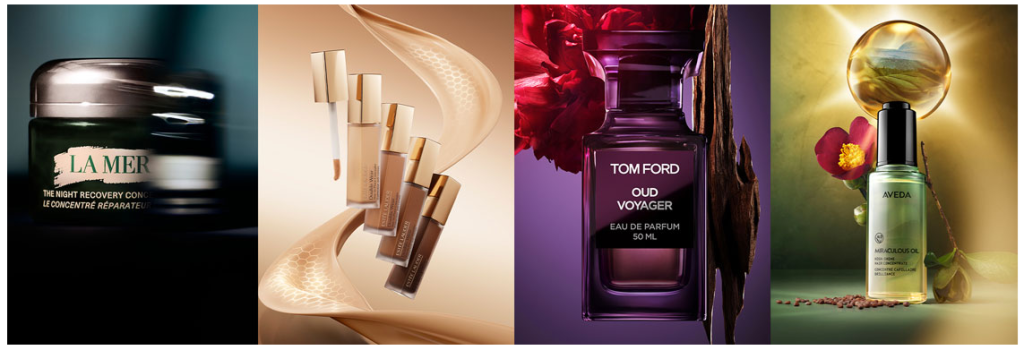

Estée Lauder (EL) is a global prestige beauty company focused on high-end skincare, makeup, fragrance, and haircare, sold in over 150 countries. Key brands include Estée Lauder, La Mer, Clinique, M·A·C, Bobbi Brown, Jo Malone London, and Tom Ford Beauty.

The company follows a June fiscal year, so Q1 = July–September, and holiday strength appears in Q2, not Q4. Travel retail, Asia, and specialty beauty retail remain critical growth channels.

📊 Financial Highlights – Estée Lauder Q1 2026 10-Q Analysis

In Q1 FY2026, Estée Lauder returned to a small profit after a loss last year. Revenue grew modestly, but operating income and net income improved sharply as one-off charges disappeared and cost discipline strengthened. Margins moved back into positive territory, confirming that the company remains a high-margin prestige beauty business, even during recovery.

Operating cash flow was still negative, but management says this is seasonal and normal for early fiscal-year quarters.

⚠️ Key Risks (Company-Specific)

The 10-Q highlights risks tied to Estée Lauder’s business model, not broad market risks. Key risks include dependence on constant product innovation, reputation sensitivity across luxury brands, and inventory or promotional pressure if demand weakens.

The business also depends heavily on major retail and travel-retail partners, must navigate ongoing restructuring under Beauty Reimagined and PRGP, and faces global supply chain and cybersecurity risks. Performance still varies significantly by region and channel.

🧭 MD&A – What Management Emphasizes

Management reports that Q1 results improved meaningfully, with better profitability and stronger execution across key brands. Skincare and fragrance showed clear momentum, while haircare (especially Aveda) remained soft.

Regionally, North America and EMEA benefited from innovation and retail execution, while travel retail and parts of Asia-Pacific remained uneven.

Management is focused on margin recovery, tighter cost control, and investment in hero products, while continuing to execute its multi-year restructuring and profit recovery plans.

✅ Takeaway For Beginners

In plain English: Estée Lauder is moving in the right direction—profits are back, margins are improving, and liquidity is stable. But the company still faces execution risks, including restructuring challenges, shifting retail channels, and uneven regional performance.

For beginners, Estée Lauder looks like a strong global beauty franchise in the middle of a multi-year turnaround, where consistent execution will matter most in upcoming quarters.

📈 Key Profitability Ratios

| Ratio | Q1 FY2026 | Q1 FY2025 |

|---|---|---|

| Gross Margin (%) | 73.4% | 72.4% |

| Operating Margin (%) | 4.9% | -3.6% |

| Net Margin (%) | 1.4% | -4.6% |

Plain English:

Gross margin stayed very strong above 70%, and even improved slightly versus last year. Operating margin turned positive as restructuring, litigation, and other costs became less of a burden. Net margin also moved from a negative to a small positive. In simple terms, Estée Lauder is still a high-margin business, and as one-off charges fade and costs normalize, more of each sales dollar is starting to drop to the bottom line again.

📝 Disclaimer

This article is intended for educational purposes only. It does not constitute financial, investment, or legal advice. All investment decisions involve risks, and readers should conduct their own research or consult with a licensed financial advisor.

👉 Estée Lauder (EL) Q1 2026 10-Q Analysis (Filed 2025) | Explained for Beginners