– A Beginner’s Guide to ETF Dividends

If you’ve ever invested in stocks, you’ve probably heard of an ex-dividend date.

But what about ETFs? Since ETFs also pay dividends, do they have ex-dividend dates too?

👉 The short answer: Yes, they do. Let’s break it down simply.

📌 What Is an Ex-Dividend Date?

Ex-dividend date is the day when the right to receive a dividend expires.

On this date, the share price usually drops by the dividend amount.

Example:

- Record date: December 28

- You must own the stock by December 27 to qualify.

- On December 28 (ex-dividend date), the stock price adjusts downward by the dividend amount.

📉 Ex-dividend = Price drops by the dividend value

(But actual price movement can vary depending on the market.)

❓ Do ETFs Have Ex-Dividend Dates?

Yes!

ETFs hold baskets of dividend-paying stocks. When those companies pay dividends, the ETF collects them and then passes them on to investors as distributions.

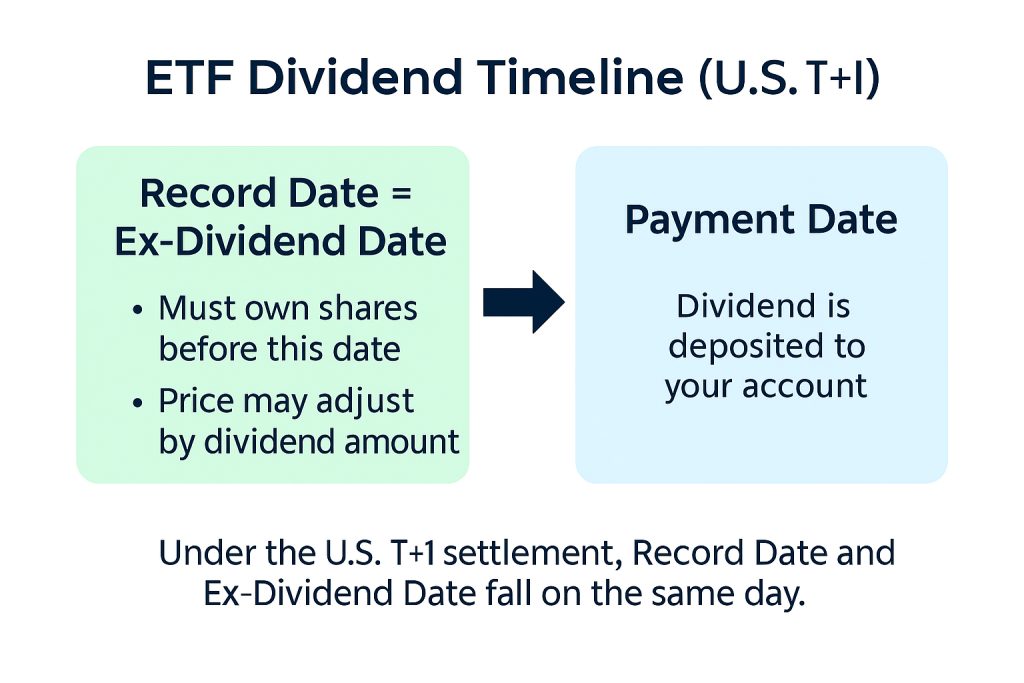

This means ETFs also follow the same schedule: record date = ex-dividend date → payment date.

📊 Example: ETF Ex-Dividend Impact

Suppose an ETF closed at $100 and paid a $1 distribution:

- Ex-dividend date: The ETF may open around $99.

- Of course, the actual price change depends on broader market conditions.

🧾 ETF Dividend Timeline

| Term | What It Means |

|---|---|

| Record Date | The cutoff date. Investors holding shares qualify. |

| Ex-Dividend Date | Price drops by dividend amount |

| Payment Date | The day cash is deposited into your account |

🔍 Do ETFs Recover After Ex-Dividend?

Most ETFs eventually recover, because they’re diversified across many stocks.

While the price drop on ex-dividend day is normal, the long-term total return (price growth + dividends) is what really matters.

🧠 Investor Tips

- ⚠️ Don’t chase dividends. Buying right before ex-dividend can backfire, since the price drops.

- 📊 Focus on total return, not just payouts.

- 🕒 Think long term. Ex-dividend dates are short-term noise for long-term investors.

📌 Key Takeaways

- ✅ ETFs do have ex-dividend dates, just like stocks.

- ✅ On the ex-dividend date, ETF prices adjust downward by the distribution.

- ✅ Long-term investors don’t need to worry too much.

- ✅ Chasing dividends is risky — focus on overall portfolio growth.

📝 Disclaimer

This article is intended for educational purposes only. It does not constitute financial, investment, or legal advice. All investment decisions involve risks, and readers should conduct their own research or consult with a licensed financial advisor.