💡 Introduction: Why Debt Ratios Matter

Debt is a double-edged sword. It can fuel growth when used wisely, but it can also sink a company when mismanaged. For investors, understanding a company’s debt profile is just as important as looking at earnings or revenue.

In this guide, we’ll break down five key debt ratios that analysts, credit agencies, and institutional investors use every day. Each ratio comes with a clear formula, easy interpretation, and investor takeaways.

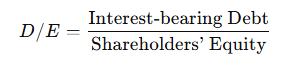

📍 1. Debt-to-Equity Ratio (D/E)

Formula:

Meaning: Shows how much a company relies on borrowed money (debt) compared to its own capital (equity).

Why it matters:

- Easy to interpret → higher D/E means greater reliance on debt.

- Commonly used by both retail and institutional investors.

- Useful for comparing capital structure risk across companies.

👉 Think of it as: “How leveraged is this company?”

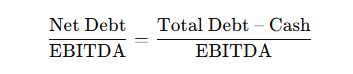

📍 2. Net Debt / EBITDA

Formula:

Meaning: Tells you how many years it would take for a company to repay its net debt using operating cash flow (approximated by EBITDA).

Why it matters:

- Private equity firms, investment banks, and credit rating agencies rely on it as a standard leverage metric.

- Critical in M&A models to assess repayment ability.

Interpretation:

- < 2× → Healthy.

- 2–4× → Manageable, industry-dependent.

- 5× → Risky, especially if earnings fall.

👉 Think of it as: “Can this company realistically pay back its debt with the cash it generates?”

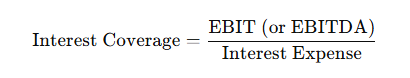

📍 3. Interest Coverage Ratio

Formula:

Meaning: Measures how many times a company can pay interest using its operating profit.

Guideline:

- ≥ 5× → Very safe.

- 2–5× → Average.

- ≤ 1× → Dangerous (can’t cover interest).

Why it matters:

- High debt is not automatically bad—as long as the company can cover interest payments comfortably.

- A must-watch metric for bond investors and credit analysts.

👉 Think of it as: “How easily can the company handle its debt payments?”

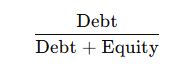

📍 4. Debt / Capital Ratio

Formula:

Meaning: Shows the proportion of debt in the company’s total capital structure.

Why it matters:

- Helps answer: “Did this company grow mainly with debt or with equity?”

- Often used in analyzing banks, insurers, and infrastructure firms.

- Complements the D/E ratio by giving a percentage-based view of leverage.

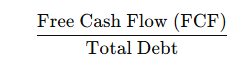

📍 5. Free Cash Flow to Debt

Formula:

Meaning: Tells how many years it would take for a company to repay debt using actual free cash flow, not accounting earnings.

Why it matters:

- More realistic than D/E, since FCF shows the true repayment ability.

- Closely tracked by hedge funds, distressed debt investors, and credit analysts.

👉 Think of it as: “Does this company generate enough free cash flow to dig itself out of debt?”

📌 Quick Comparison Table

| Ratio | Formula | Focus | Key Insight |

|---|---|---|---|

| D/E | Debt ÷ Equity | Leverage | How much debt vs. equity |

| Net Debt/EBITDA | (Debt – Cash) ÷ EBITDA | Repayment capacity | Years to repay debt with cash flow |

| Interest Coverage | EBIT ÷ Interest Expense | Debt service ability | Can they cover interest safely? |

| Debt/Capital | Debt ÷ (Debt + Equity) | Capital structure | Debt share in financing mix |

| FCF/Debt | Free Cash Flow ÷ Debt | Real repayment power | Can FCF pay off debt? |

✅ Investor Takeaways

- Check multiple ratios together—no single metric tells the full story.

- For growth companies, watch Net Debt/EBITDA and Interest Coverage closely.

- For mature firms, FCF/Debt is often the most realistic test.

- Banks and insurers are special cases—look at Debt/Capital and industry norms.

📌 Pro Tip: A company with high debt but strong interest coverage may be safer than one with low debt but weak cash flow. Always connect leverage to cash generation.

🔑 Final Thoughts

Debt ratios are more than numbers—they’re risk indicators. By mastering these five, you’ll understand not only whether a company is profitable, but whether it can survive financial stress.

As a beginner investor, add these ratios to your analysis toolkit, and you’ll quickly see why professionals—from credit analysts to hedge funds—rely on them every day.

📝 Disclaimer

This article is intended for educational purposes only. It does not constitute financial, investment, or legal advice. All investment decisions involve risks, and readers should conduct their own research or consult with a licensed financial advisor.