If you’ve ever overheard investors saying things like:

“Company A has a P/E of 10.”

“Low P/E means undervalued, right?”

👉 They’re talking about the P/E ratio — one of the most popular ways to figure out if a stock is expensive or cheap.

Let’s break it down in simple terms.

✅ What Is the P/E Ratio?

P/E = Price-to-Earnings Ratio

In plain English:

👉 It tells you how many years of earnings it would take for a company to “earn back” its stock price.

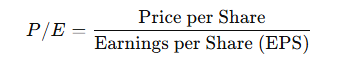

✏️ How to Calculate P/E

The formula is simple:

Example:

- Current stock price: $30

- EPS (Earnings per Share): $3

- P/E = 30 ÷ 3 = 10

This means it would take 10 years of current earnings to match the price you’re paying for one share.

(Of course, earnings change over time — this is just a simplified example.)

💬 Why Does the P/E Ratio Matter?

✅ 1. Valuation check

- High P/E → The stock may be expensive relative to earnings.

- Low P/E → The stock may be undervalued.

✅ 2. Easy comparisons within industries

Example: If the average P/E for semiconductor stocks is 15, but one company trades at 8, it might be undervalued compared to peers.

✅ 3. Growth expectations count

A high P/E isn’t always bad. If investors believe profits will grow rapidly, they’re often willing to pay more now.

➡️ That’s why growth stocks often have higher P/E ratios.

📉 Common Misconceptions

❌ “Low P/E = Always undervalued.”

Not true! A low P/E might mean:

- The company’s earnings are falling.

- The industry is struggling.

- Investors see high risk ahead.

Always dig deeper before assuming a stock is “cheap.”

📊 P/E Ratio Quick Recap

| Category | Explanation |

|---|---|

| Formula | Price ÷ EPS |

| Meaning | Shows how many years of earnings equal the stock price |

| Insight | Low P/E = possible undervaluation, High P/E = possible overvaluation |

| Caution | Best used when comparing within the same industry |

📝 Final Thoughts

The P/E ratio is one of the most widely used tools in stock investing.

But don’t stop at just the number.

👉 To make smarter decisions, combine it with:

- EPS growth trends 📈

- Industry-average P/E ⚖️

- Future earnings outlook 🔮

That way, you’ll avoid the trap of buying a stock just because it looks “cheap.”

“Price is what you pay, value is what you get.” – Warren Buffett

📝 Disclaimer

This article is intended for educational purposes only. It does not constitute financial, investment, or legal advice. All investment decisions involve risks, and readers should conduct their own research or consult with a licensed financial advisor.