💡 What Is the PEG Ratio?

The PEG ratio helps investors evaluate a stock’s valuation and growth at the same time.

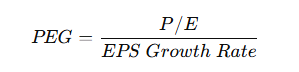

Formula:

It tells you whether a stock’s price-to-earnings ratio (P/E) is justified by its earnings growth rate.

Interpretation:

- PEG < 1: Undervalued relative to growth

- PEG = 1: Fairly valued

- PEG > 1: Overvalued relative to growth

👉 In short: PEG shows whether a company’s price matches its growth potential.

🧠 Origin — Peter Lynch’s Approach

The legendary investor Peter Lynch introduced the PEG concept in his 1989 classic “One Up on Wall Street.”

He said:

“Don’t just look at P/E. Always compare it with the company’s growth rate.”

At the time, analysts had limited access to forecast data, so Lynch used a hybrid method:

- Historical growth (past EPS trends)

- Estimated future growth (his own forecast)

His approach sat between Historical PEG and Forward PEG — a mix of reality and expectation.

👉 Lynch’s rule of thumb:

“A P/E lower than the growth rate usually means a stock is cheap.”

💰 Example: How to Calculate PEG

| Metric | Example Value | Calculation |

|---|---|---|

| Stock Price | $150 | |

| EPS (Earnings Per Share) | $5 | |

| P/E Ratio | 150 ÷ 5 | = 30× |

| Expected EPS Growth (Next Year) | 20% | |

| PEG Ratio | 30 ÷ 20 | = 1.5 |

➡ A PEG of 1.5 suggests the stock may be slightly expensive relative to its growth.

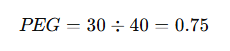

If the expected growth were 40%, then:

➡ In that case, the stock would look undervalued based on growth potential.

📊 How to Calculate EPS Growth

There are three common ways to measure EPS growth rate:

| Type | Formula | Description |

|---|---|---|

| Historical Growth | (Current EPS – Previous EPS) ÷ Previous EPS × 100 | Based on past results; objective but backward-looking. |

| Forward Growth | (Next Year’s EPS Estimate – Current EPS) ÷ Current EPS × 100 | Based on analyst forecasts; forward-looking. |

| CAGR (Compound Annual Growth Rate) | ((Latest EPS ÷ Old EPS)^(1/Years) – 1) × 100 | Tracks multi-year average growth. |

Example:

- Last year’s EPS = $4

- This year’s EPS = $5

→ Historical growth = (5 – 4) ÷ 4 × 100 = 25%

If next year’s estimated EPS = $6,

→ Forward growth = (6 – 5) ÷ 5 × 100 = 20%

👉 PEG works best when you combine current valuation (P/E) with expected growth (Forward EPS).

🧩 Historical PEG vs. Forward PEG

| Feature | Historical PEG | Forward PEG |

|---|---|---|

| Growth Basis | Past EPS growth | Forecasted EPS growth (1–3 years) |

| Data Source | Financial statements | Analyst consensus estimates |

| Advantage | Based on real, reported results | Forward-looking; reflects market expectations |

| Limitation | Backward-looking | Relies on estimates that may be optimistic |

| Best Use | Reviewing past performance | Comparing future valuation potential |

➡ Today, Forward PEG is the industry standard, because investors have access to real-time analyst forecasts through financial terminals and data providers.

⚠️ Key Limitations and Pitfalls

The PEG ratio is simple and popular — but it’s not perfect.

Here’s what to watch out for:

1️⃣ Unstable growth rates

- For cyclical companies, temporary profit spikes can make PEG look artificially low.

- When earnings normalize, the “cheap” PEG disappears.

2️⃣ Reliance on forecasts

- Forward PEG depends on analyst estimates, which can be overly optimistic.

- A low PEG doesn’t always mean undervaluation — it could mean overestimated growth.

3️⃣ Different growth calculation bases

- Some analysts use year-over-year (YoY) growth, others use CAGR.

- PEGs from different sources may not be directly comparable.

📌 Pro Tip: Always double-check what growth rate definition the data provider uses.

🧠 Key Takeaways

- PEG = (P/E) ÷ (EPS Growth Rate) — a hybrid measure of valuation and growth.

- Peter Lynch’s PEG used a mix of historical and forward growth.

- Forward PEG is now the Wall Street standard.

- PEG < 1 may signal opportunity — but context matters.

👉 The PEG ratio is not an absolute rule; it’s a cross-check tool that helps investors judge whether a stock’s valuation aligns with its growth potential.

✅ Summary

| Concept | Key Point |

|---|---|

| Formula | (P/E) ÷ (EPS Growth Rate) |

| Origin | Peter Lynch’s “balance between growth and valuation” |

| Current Standard | Forward PEG based on analyst forecasts |

| Caution | Varying growth definitions and optimistic estimates can distort results |

| Conclusion | PEG is a supporting indicator, not a standalone valuation metric |

💬 Final Thought

For beginner investors, PEG offers a bridge between growth investing and value investing.

It helps you avoid overpaying for fast-growing companies — and spot opportunities where growth and price are in sync.

As Peter Lynch famously said:

“Growth drives value. The trick is knowing how much you’re paying for it.”

📝 Disclaimer

This article is intended for educational purposes only. It does not constitute financial, investment, or legal advice. All investment decisions involve risks, and readers should conduct their own research or consult with a licensed financial advisor.