Why China’s Export Restrictions Could Hit the U.S. Economy Hard

📌 Introduction – Why Rare Earths Matter in the Global Economy

Recently, China announced export restrictions on certain rare earth elements, escalating tensions with the U.S. and other Western nations.

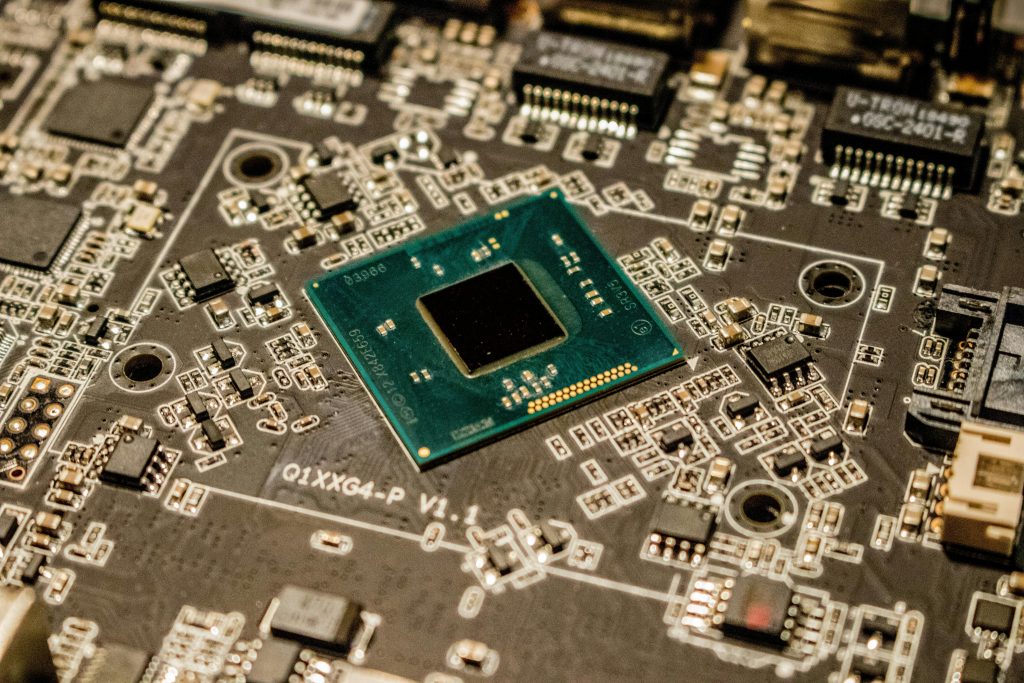

Rare earths are the “vitamins” of modern technology — essential for smartphones, electric vehicles (EVs), semiconductors, and defense systems.

Price swings in rare earth markets aren’t just a commodity story — they directly impact national security, technology competition, and industrial growth.

For investors, rare earths can be a short-term speculative play, but more importantly, they are a long-term strategic theme tied to the clean energy transition and technological innovation.

🧪 What Are Rare Earth Elements (REEs)?

Definition: A group of 17 elements — the lanthanide series (15 elements) plus scandium and yttrium.

Not-so-rare truth: While rare earths are widely distributed in the Earth’s crust, mining and refining are complex, costly, and environmentally challenging.

Key properties:

- Strong magnetism

- Unique luminescence

- Excellent electrical and thermal conductivity

These traits make rare earths indispensable for high-tech industries.

🚗 Where Rare Earths Are Used – Why Demand Is So Strong

- EV Batteries & Motors → Neodymium and Praseodymium for powerful permanent magnets

- Smartphones & Semiconductors → Yttrium and Europium for display phosphors and wafer production

- Renewable Energy → Wind turbine magnets, high-efficiency solar panels

- Defense & Aerospace → Fighter jet systems, missile guidance, submarine sonar

Bottom line: Modern industry and defense systems cannot function without rare earths.

🌍 Global Reserves & Production

Major reserve holders: China, Brazil, Vietnam, Russia, India, U.S.

Production dominance:

- China → 60–70% of global refining capacity

- U.S. → Mountain Pass mine in Nevada

- Australia → Lynas Rare Earths, a top non-China supplier

Key factor: Refining & separation technology matters more than raw reserves — and China currently leads by a wide margin.

🏆 How China Took Control of the Rare Earth Market

- Accepting environmental costs – Large-scale mining despite radiation and chemical waste

- Refining & separation expertise – U.S. ores often shipped to China for processing

- Strategic resource management – Export quotas, government-led industrial policy

🇺🇸 How the U.S. Is Responding

- Supply chain diversification – Partnerships with Australia, Canada, and African nations

- Domestic production expansion – MP Materials reviving Mountain Pass operations

- Recycling innovations – Recovering rare earths from EVs and e-waste

- Allied projects – Joint U.S.–Australia refining facilities

💼 Key Rare Earth Companies

U.S.-based

MP Materials (NYSE: MP)

- Only large-scale REE producer in the U.S.

- Operates Mountain Pass mine in Nevada

Outside China

- Lynas Rare Earths (ASX: LYC) – Australia-based, refining in Malaysia

- Arafura Rare Earths (ASX: ARU) – Focused on EV and wind industries

- Vital Metals (ASX: VML) – Building a North American supply chain

U.S. Defense-backed Projects

MP Materials (NYSE: MP)

- $400M investment from U.S. Department of Defense (DoD) → largest shareholder (~15%)

- $150M unsecured loan + 10-year price floor for NdPr magnets

- Building a 10,000-ton/year magnet plant with JPMorgan & Goldman Sachs financing

Ucore Rare Metals (TSXV: UCU)

- $18.4M DoD funding for a heavy REE refining facility in Louisiana

- Targets critical elements like terbium & dysprosium

📊 Investment Perspective

Top publicly traded rare earth companies:

| Company | Country | Ticker | Exchange | Highlights |

|---|---|---|---|---|

| MP Materials | U.S. | MP | NYSE | Only large-scale U.S. producer |

| Lynas Rare Earths | Australia | LYC | ASX | Largest non-China refiner |

| Arafura Rare Earths | Australia | ARU | ASX | EV & wind energy focus |

| Vital Metals | Canada | VML | ASX | North American supply chain |

Price Volatility & Cycles

- Highly sensitive to geopolitics, export restrictions, and trade disputes

- Example: 2010 China–Japan territorial dispute → prices spiked 3–5x

Long-term Growth Drivers & Risks

Growth drivers: EV adoption, renewable energy boom, semiconductor demand

Risks: Substitution research, recycling advances, shifting policies

ETFs & Funds

- VanEck Rare Earth/Strategic Metals ETF (REMX)

- Global X Lithium & Battery Tech ETF (LIT) – includes some REE exposure

⚠️ Risks for Investors

- Extreme volatility due to news events

- Must assess financial health and production capacity before long-term investing

💡 Key Takeaways

Rare earths are not just commodities — they are the backbone of modern technology and military power.

China’s dominance creates both investment opportunities and risks.

Investors should factor in political, environmental, and technological variables before entering the market.

📝 Disclaimer

This article is intended for educational purposes only. It does not constitute financial, investment, or legal advice. All investment decisions involve risks, and readers should conduct their own research or consult with a licensed financial advisor.