When learning stock investing, two of the most common metrics you’ll see are ROA (Return on Assets) and ROE (Return on Equity).

At first glance, they may seem similar, but once you factor in debt (leverage), the picture changes dramatically. Let’s break it down in simple terms.

✅ ROA vs. ROE: The Basics

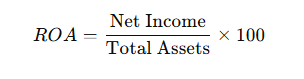

ROA (Return on Assets)

👉 Shows how efficiently a company generates profit using its total assets.

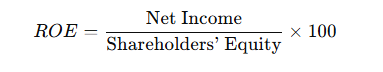

ROE (Return on Equity)

👉 Shows how much profit a company generates using only shareholders’ equity.

🔑 In short:

- ROA = efficiency of all assets (equity + debt)

- ROE = profitability from shareholders’ perspective

💡 The Link Between ROE and Debt

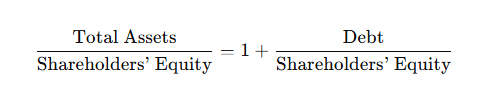

A company’s assets are made up of Equity + Debt.

The more debt it uses, the smaller the equity portion becomes.

👉 This means that even if ROA stays the same, ROE can look much higher simply because equity is reduced.

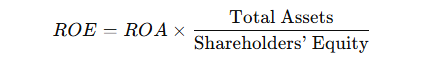

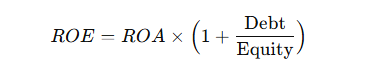

This relationship is called the financial leverage effect:

Since:

We can also write:

📌 This shows directly that the higher the debt-to-equity ratio, the higher the ROE (for the same ROA).

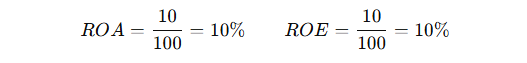

📝 Example: Same ROA, Different ROE

Company A

- Total Assets = $100M

- Debt = $0

- Net Income = $10M

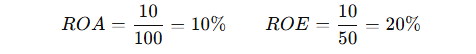

Company B

- Total Assets = $100M

- Debt = $50M

- Equity = $50M

- Net Income = $10M

👉 Both companies have the same ROA (10%),

but Company B’s ROE doubles to 20% because it used debt.

⚠️ Why Investors Should Be Careful

- A high ROE doesn’t always mean a strong company.

- Sometimes, it’s just the result of high leverage.

- ROA reflects the company’s true efficiency.

- ROE can be inflated by debt.

That’s why serious investors always check ROA and the debt ratio alongside ROE.

📌 Quick Summary

| Metric | What It Shows | Key Insight |

|---|---|---|

| ROA | Profitability of total assets | True efficiency of all resources |

| ROE | Profitability of equity only | Can be boosted by debt |

| Rule | Same ROA → Higher debt = Higher ROE | Beware of leverage “illusions” |

🏁 Final Thoughts

Financial statements often reveal more than meets the eye.

A company with high ROE may look attractive, but if that performance comes from heavy borrowing, the risk increases.

👉 Always look at ROE, ROA, and debt ratio together. That’s how you separate companies that rely on debt from those that truly generate strong returns.

📝 Disclaimer

This article is intended for educational purposes only. It does not constitute financial, investment, or legal advice. All investment decisions involve risks, and readers should conduct their own research or consult with a licensed financial advisor.

👉 What Is ROA? A Beginner’s Guide to Return on Assets

👉 What Is ROE? A Beginner’s Guide to Return on Equity

👉 ROE vs ROA – Why You Should Always Look at Both

👉 Debt-to-Equity Ratio (D/E) and Interest Coverage Ratio – Measuring a Company’s Financial Health