💡 Introduction: Why These Ratios Matter

When evaluating a company’s profitability and efficiency, investors often hear terms like ROA, ROTC, and ROIC. At first glance, they may look similar—but each tells a slightly different story.

In this beginner-friendly guide, we’ll break down:

- What each ratio measures.

- How they’re calculated.

- Why EBIT (Earnings Before Interest and Taxes) is so important in the mix.

By the end, you’ll know exactly when to use ROA, ROTC, or ROIC in your stock analysis.

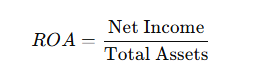

🏦 ROA – Return on Assets

Formula:

Meaning: Measures how efficiently a company uses its total assets (cash, debt, property, etc.) to generate net income.

Key Points:

- Focuses only on overall asset efficiency, ignoring capital structure (debt vs. equity mix).

- Often lower in asset-heavy industries like banks and insurers.

👉 Think of ROA as: “How much profit does each dollar of assets generate?”

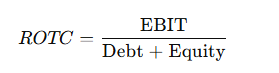

💳 ROTC – Return on Total Capital

Formula:

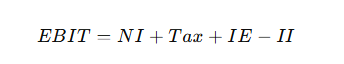

Here, EBIT (Earnings Before Interest and Taxes) plays a crucial role.

EBIT Definition (US GAAP context):

In practice, analysts often approximate EBIT as Operating Income, especially when non-operating items are small.

Meaning: Shows how efficiently a company uses both equity (shareholder capital) and debt (borrowed funds) to generate operating profit.

Key Points:

- Excludes taxes, so it focuses on profit available to both shareholders and creditors.

- Useful for comparing companies with different tax environments.

👉 Think of ROTC as: “How well does the business generate profits from all the capital it controls?”

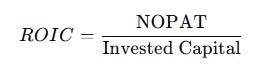

💼 ROIC – Return on Invested Capital

Formula:

Where:

- NOPAT (Net Operating Profit After Tax) = EBIT – Taxes.

- Invested Capital = Total assets – Non-operating assets (e.g., excess cash).

Meaning: Measures how efficiently management uses capital directly invested in the business to generate after-tax operating profit.

Key Points:

- Strips out non-core assets for a cleaner picture of true business efficiency.

- Widely used by value investors and private equity analysts.

👉 Think of ROIC as: “How good is management at turning invested dollars into after-tax profits?”

📌 Quick Comparison – ROA vs ROTC vs ROIC

| Metric | Formula | Focus | Best Used For |

|---|---|---|---|

| ROA | Net Income ÷ Total Assets | Asset efficiency | Asset-heavy industries, banks |

| ROTC | EBIT ÷ (Debt + Equity) | Efficiency of all capital | Comparing leverage impact |

| ROIC | NOPAT ÷ Invested Capital | Core operating capital efficiency | Evaluating management performance |

✅ Investor Takeaways

- Use ROA if you want to check a company’s overall efficiency with its assets.

- Use ROTC when you want to see how both debt and equity are working together.

- Use ROIC for the most realistic measure of management performance, since it accounts for taxes and only considers capital tied directly to operations.

📌 Pro Tip: Many professional investors consider ROIC the gold standard because it reflects both operating performance and capital allocation decisions.

🔑 Final Thoughts

ROA, ROTC, and ROIC are like three different camera lenses. Each one zooms in on a company’s profitability from a slightly different angle. As a beginner investor, you don’t need to memorize every formula—but you should understand which lens to use and when.

By mastering these ratios, you’ll build a stronger foundation for evaluating stocks beyond just earnings per share or revenue growth.

📝 Disclaimer

This article is intended for educational purposes only. It does not constitute financial, investment, or legal advice. All investment decisions involve risks, and readers should conduct their own research or consult with a licensed financial advisor.