When analyzing stocks, one key metric you’ll often hear about is BPS.

“Company A has a BPS of $15.”

“The stock trades way above its BPS. Isn’t that overvalued?”

But what exactly does BPS mean, and why does it matter? Let’s break it down in simple terms.

✅ what is bps?

BPS = Book Value Per Share

👉 It represents how much net assets (shareholders’ equity) each share of stock actually carries.

In other words:

If you own one share, BPS tells you the real asset value behind that single share.

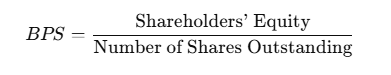

✏️ how to calculate bps

The formula is simple:

Example:

- Total shareholders’ equity: $10 billion

- Shares outstanding: 1 billion

- 👉 BPS = $10 billion ÷ 1 billion = $10 per share

So, each share represents $10 of real asset value.

💬 why bps matters

✅ 1. Valuation check: Overvalued or undervalued?

If the stock price is below BPS → the market values it cheaper than its assets.

This leads to another useful ratio:

[latex display]\text{PBR} = \frac{\text{Price per Share}}{\text{BPS}}[/latex]

✅ 2. Linked to liquidation value

If the company shut down and sold its assets, BPS reflects the approximate amount each shareholder could claim.

📉 is a low bps always bad?

Not necessarily!

- Companies with strong intangible assets (brands, patents, technology) may be worth far more than their BPS.

- On the flip side, a company with high BPS but poor profitability may not be an attractive investment.

📝 quick recap

| Metric | Meaning | Formula | Usage |

|---|---|---|---|

| BPS | Book Value Per Share = asset value per share | Equity ÷ Shares Outstanding | Used to check if stock is over/undervalued → basis for PBR |

✨ final thoughts

BPS is one of the foundational metrics in stock investing.

- PER tells you how expensive a stock is based on earnings.

- BPS tells you how expensive a stock is based on assets.

👉 A stock trading below BPS isn’t always a hidden gem, but BPS gives you an essential perspective on a company’s stability, valuation, and long-term safety.

📝 Disclaimer

This article is intended for educational purposes only. It does not constitute financial, investment, or legal advice. All investment decisions involve risks, and readers should conduct their own research or consult with a licensed financial advisor.