If you’ve ever heard phrases like:

“Company A has a high ROA — they manage assets really well.”

“Company B’s ROE looks good, but its ROA is low. Something feels off.”

They’re talking about ROA (Return on Assets) — a key metric to measure how efficiently a company uses all of its resources. Let’s break it down in simple terms.

✅ what is roa?

ROA = Return on Assets

In plain English:

👉 ROA tells you how much profit a company generates with all of its assets (equity + debt).

It answers the question: “How efficiently is the company using everything it owns to make money?”

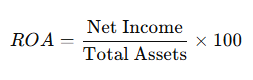

✏️ how to calculate roa

The formula is simple:

Example:

- Total Assets: $2,000M

- Net Income: $100M

- ROA = 100 ÷ 2,000 × 100 = 5%

👉 This means the company earned a 5% return on its total assets in one year.

💬 why roa matters

1. Measures total asset efficiency

- ROE only looks at shareholder equity.

- ROA includes both equity + debt → a broader view of efficiency.

2. Less distorted by debt

- Companies can artificially boost ROE by using more debt.

- ROA is harder to manipulate since it considers all assets.

3. Reflects real management performance

- A higher ROA = better use of resources.

- Helps investors spot companies that truly operate efficiently.

📉 roe vs roa: key differences

| Factor | ROE | ROA |

|---|---|---|

| Basis | Equity only | Total Assets (Equity + Debt) |

| Debt Effect | More debt → higher ROE | Debt included → more stable |

| Meaning | Profitability for shareholders | Overall efficiency of the business |

💡 If ROE is high but ROA is low → it might signal heavy debt use. Always check financial health!

✅ roa summary

- Metric: ROA (Return on Assets)

- Formula: Net Income ÷ Total Assets × 100

- Meaning: How efficiently the company uses all assets to generate profit

- Higher is better: Stronger efficiency & management

- Best Use: Combine with ROE to evaluate debt impact

📝 simple example

| Company | Net Income | Total Assets | ROA |

|---|---|---|---|

| A Corp | $100M | $2,000M | 5% |

| B Corp | $100M | $1,000M | 10% |

👉 Even though both earned $100M, B Corp is more efficient because it generated the same income with fewer assets.

💬 final thoughts

ROA is a vital metric to understand how well a company manages all of its resources.

- ROE shows profitability for shareholders.

- ROA shows overall business efficiency.

For investors, the strongest signal comes when ROE is consistently high AND ROA is solid, confirming both profitability and financial health.

📝 Disclaimer

This article is intended for educational purposes only. It does not constitute financial, investment, or legal advice. All investment decisions involve risks, and readers should conduct their own research or consult with a licensed financial advisor.