If you’ve studied stocks, you’ve probably come across metrics like P/E and P/B.

Another equally important one is ROE.

👉 “A company with high ROE is efficient at making money.”

👉 “Low ROE can mean weak profitability.”

But what exactly is ROE, and why do investors care so much? Let’s break it down.

✅ what is roe?

ROE = Return on Equity

It measures how much profit a company generates using shareholders’ equity (the money invested by owners).

👉 In simple terms:

It shows how efficiently a company turns investor capital into profits.

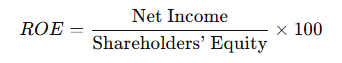

✏️ how to calculate roe

The formula is straightforward:

Example:

- Shareholders’ Equity = $1,000M

- Net Income = $100M

- ROE = 100 ÷ 1,000 × 100 = 10%

💡 This means the company earned 10% on shareholder money in one year.

💬 why roe matters

1. efficiency of capital use

Two companies may earn the same profit, but the one using less equity is more efficient. Higher ROE = better management performance.

2. key metric for shareholders

Since equity belongs to investors, ROE tells you how much return you get on your capital.

3. growth potential

Firms with consistently high ROE tend to reinvest efficiently and grow faster.

⚠️ things to watch out for

- Sustainability matters → One-time high ROE is less meaningful.

- Too high isn’t always good → Could be due to excessive debt boosting returns.

- Compare within the same industry → A bank’s 10% ROE ≠ a tech firm’s 10% ROE.

📊 quick summary

| Metric | Meaning |

|---|---|

| ROE | Return on Equity |

| Formula | Net Income ÷ Equity × 100 |

| Interpretation | Higher = better use of investor capital |

| Caution | Check trend over time + compare within industry + watch debt levels |

📝 easy example

| Company | Net Income | Equity | ROE |

|---|---|---|---|

| A Corp | $100M | $1,000M | 10% |

| B Corp | $100M | $500M | 20% |

👉 Even though both earn $100M, B Corp is more efficient, because it needed only half the capital to generate the same profit.

📌 final thoughts

ROE is one of the most important measures of how effectively a company uses shareholders’ money.

While P/E and P/B help you decide if a stock is over- or undervalued, ROE shows how well the company is actually run.

🔑 The best investors look for companies with consistently high, stable ROE and solid fundamentals.

📝 Disclaimer

This article is intended for educational purposes only. It does not constitute financial, investment, or legal advice. All investment decisions involve risks, and readers should conduct their own research or consult with a licensed financial advisor.